Interpreter Insurance – Professional Indemnity Insurance for interpreters and Freelance Translators

Are you a freelance translator or interpreter working in diverse fields like law, health and social care without effective insurance for interpreters? It’s crucial to protect yourself and your business with the right business insurance. Get affordable professional indemnity insurance for interpreters and freelance translators tailored to your needs online in less than 10 minutes. Here’s why it is so important.

Do translators and interpreters need insurance?

As a freelance translator or interpreter, you play a vital role in facilitating communication. However, unforeseen circumstances can lead to errors or misunderstandings. That’s where insurance comes in to safeguard your business and reputation.

Is the Insurance for interpreters the same as for translators?

While the essence of coverage is similar, there are specific nuances for translators in health and social care. Tailored insurance ensures you have the right protection for your unique risks. So, what type of insurance do freelance translators and interpreters need?

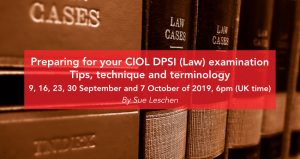

Professional indemnity insurance for interpreters and freelance translators

Professional indemnity insurance is a cornerstone for language professionals. It protects against claims of professional negligence, ensuring you’re covered if a client alleges errors or omissions in your work.

What does professional indemnity insurance cover?

Professional indemnity insurance typically covers legal costs, damages, and expenses associated with defending a claim. It acts as a safety net, allowing you to focus on your work without worrying about potential financial setbacks.

How much professional indemnity insurance do I need?

Determining the right coverage depends on factors like the nature of your work, client requirements, and industry standards. PolicyBee can help tailor a policy that fits your specific needs.

How much does business insurance for interpreters cost?

The cost varies based on factors such as coverage limits and the scope of your services. Various options and levels of cover are available to freelance translators and interpreters depending on their circumstances and needs. These are designed to provide comprehensive protection without breaking the bank.

Interpreter insurance – What else may I need?

Public liability insurance for interpreters and translators

What’s typically covered by public liability insurance?

Public liability insurance covers you in case of injury or property damage to third parties during your work. It’s an extra layer of protection that complements professional indemnity coverage. It can cover legal costs, compensation claims, and medical expenses arising from incidents that occur during your work.

Business and office equipment insurance

What’s typically covered by business and office equipment insurance?

This insurance safeguards your essential tools, ensuring that your business can continue even if your equipment is damaged, lost, or stolen.

Legal expenses insurance

What’s typically covered by legal expenses insurance?

Legal expenses insurance helps cover the costs of legal disputes, offering peace of mind in case you encounter legal challenges related to your work.

Personal accident insurance

What’s typically covered by personal accident insurance?

Personal accident insurance provides financial support in case of accidents or injuries that prevent you from working. It ensures your income is protected during challenging times.

Interpreter insurance – Get a quote online in less than 2 minutes

Don’t let the unexpected jeopardize your freelance translation or interpreting business. Get peace of mind with PolicyBee and their tailored insurance solutions. Get a quote now and save up to 10%.

Read more

-

Online Scams Targeting Freelance Translators and Interpreters

The Silent Heist: Online Scams Targeting Freelance Translators and Interpreters As more people embrace the freelance lifestyle and offer their skills and services to clients around the world, the digital…

-

Interpreter Insurance – Professional Indemnity Insurance for interpreters and Freelance Translators

Interpreter Insurance – Professional Indemnity Insurance for interpreters and Freelance Translators Are you a freelance translator or interpreter working in diverse fields like law, health and social care without effective…

-

The risks of working as a freelance or subcontracted linguist

Freelance and subcontracted linguists. Same thing, right? Well, yes and no. They’re both self-employed, independent people. Broadly, they do the same thing. But when it comes to how they…

Leave a Comment